Key takeaways

A consistent, well-structured settlement process helps personal injury firms resolve cases faster and plan more reliably for revenue.

Common bottlenecks—like intake delays, documentation gaps, and unclear negotiations—can be avoided with the right systems and tools.

Each stage of the settlement process presents an opportunity to improve accuracy, transparency, and client experience.

Tools like 8am CasePeer support more efficient settlement management by centralizing tasks, tracking payments, and improving financial oversight through all the steps in a personal injury lawsuit.

As a personal injury attorney, your priority is to secure fair compensation for your client as quickly and efficiently as possible. Yet the road to resolution is rarely predictable.

Estimates of the average personal injury settlement in the U.S. typically range between $40,000 and $50,000, but outcomes can vary significantly depending on factors like injury severity, case type, and strength of evidence. For attorneys managing a steady volume of cases, that variability makes it especially important to have a streamlined settlement process in place.

Implementing a consistent, well-organized settlement workflow can play an essential role in solidifying your practice’s financial outcomes. According to the 8am™ 2025 Legal Industry Report, 68% of lawyers at small firms cite cash flow instability as a top concern—and unpredictable payout timelines often contribute to this challenge.

When firms can move cases efficiently from intake to resolution, it becomes easier to forecast revenue, plan for expenses, and avoid cash shortfalls.

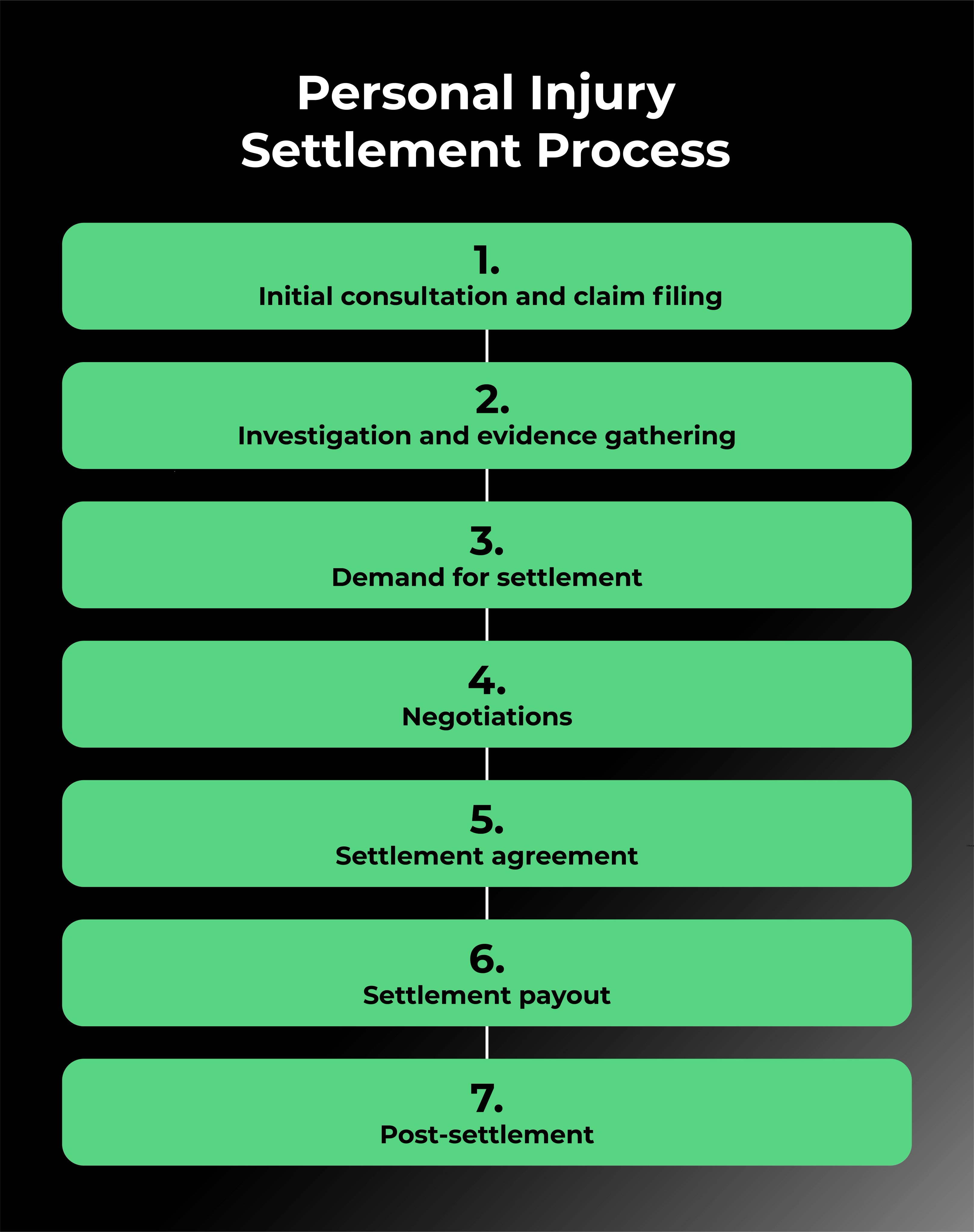

There are multiple stages of a personal injury case settlement, from intake and claim filing to negotiations, disbursement, and final accounting. Understanding how to manage each of these steps consistently is key to driving better outcomes for your clients and maintaining financial stability for your firm.

This guide breaks down every step of the settlement process and offers practical tips for improving speed, accuracy, and client satisfaction.

How to optimize the personal injury settlement process

While no two cases are identical, many personal injury matters follow a familiar path from intake to final payout. Understanding the steps in the personal injury case process—and where common slowdowns occur—helps law firms manage their caseloads more efficiently and establish more predictable revenue cycles. It also enables attorneys to deliver a better experience for clients, who are often navigating financial stress and uncertainty during the settlement process.

Below, we’ll walk through each major phase of a typical settlement and offer suggestions for improving accuracy, communication, and turnaround times.

Stage | Description | Challenge | Recommendation |

Initial consultation and claim filing | Assess liability, damages, and case strength before filing a claim. | Time-consuming intake slows progress for nearly 60% of firms. | Use standardized intake forms and digital tools to speed up the process. |

Investigation and evidence gathering | Collect records, witness statements, and supporting evidence. | 42% of firms report delays due to slow medical documentation. | Create centralized folders and use tracking tools for record requests. |

Demand for settlement | Submit a letter outlining injuries, treatment, and requested compensation. | Lack of standardization leads to missed opportunities and slower resolution. | Use demand templates and checklists to ensure consistency and accuracy. |

Negotiations | Exchange offers and counteroffers to agree on a settlement amount. | Over 30% of delays are caused by communication gaps. | Set internal follow-ups and maintain transparent communication logs. |

Settlement agreement | Finalize and sign the agreement outlining terms and payment structure. | 1 in 5 settlements have billing or payout errors due to overlooked details. | Use double-review procedures for release clauses and payment terms. |

Payout | Distribute funds to the client per the settlement agreement. | Delayed payments hurt cash flow; digital methods process 72% within 24 hours. | Track disbursements with digital reports to ensure timely payment. |

Post-settlement | Deduct fees, pay liens, and complete final disbursement. | 15% of revenue leakage is due to inconsistent expense reporting. | Conduct post-settlement audits and maintain accurate accounting records. |

1. Initial consultation and claim filing

At the outset of any case, attorneys need to quickly assess whether the client has a viable claim. This typically includes evaluating liability, estimating damages, confirming insurance coverage, and determining whether the potential settlement justifies the time and resources required to pursue it.

Despite the importance of this step, it’s also one of the most common bottlenecks. According to the 2025 Legal Industry Report, nearly 60% of small firms cite time-consuming case intake as a significant challenge, often leading to delays that ripple through the rest of the settlement process.

Recommendations:

Use standardized intake forms and early medical authorization requests to collect essential information—such as accident details, medical treatment summaries, and contact information—at the beginning of the engagement.

Pair these forms with digital intake tools to speed up the process, reduce manual entry, and prevent important details from getting lost.

2. Investigation and evidence gathering

Once a claim is filed, the next priority is building a strong evidentiary foundation. This often involves gathering materials like medical records, police reports, photographs, and witness statements to support the client’s case. Thorough documentation not only strengthens a potential settlement but also prepares the attorney for negotiations or trial if needed.

However, many firms run into issues at this stage. The Legal Industry Report found that 42% of firms struggle with delays in managing medical documentation, a problem that frequently pushes settlement timelines further out.

Recommendations:

Create centralized digital folders for each case to keep all evidence organized in one accessible location.

Use automated tracking tools for record requests—this makes it easier to monitor outstanding items, follow up with providers, and avoid unnecessary hold-ups.

3. Demand for settlement

Once the investigation is complete and the attorney has gathered sufficient documentation, the next step is submitting a demand package, which includes a demand letter, medical bills, records, photos, and other materials. These documents outline the facts of the case, the injuries sustained, the medical treatment received, and the total compensation being sought. A well-written demand letter sets the tone for negotiations and can influence how quickly and favorably a case resolves.

Firms that take a consistent approach to this step tend to see better results. According to the Legal Industry Report, firms with standardized demand processes close 23% more cases within six months compared to firms that lack standard processes. Consistency ensures that all relevant details are included and that nothing important is missed or undervalued.

Recommendations:

Create a demand package review checklist to confirm that damages, treatment costs, and future care needs are fully documented.

Use demand letter templates to prepare accurate, persuasive demands while saving time on repetitive drafting tasks.

4. Negotiations

Negotiation is where much of the hard work of settlement takes place. Attorneys and insurance representatives go back and forth with offers and counteroffers, aiming to reach a number that both sides find acceptable. This stage can move quickly or stretch out for weeks, depending on the quality of communication and the strength of the evidence presented.For firms aiming to master how to win a personal injury lawsuit, effective negotiation practices are essential.

However, internal disorganization often slows this process down. The Legal Industry Report found that communication gaps are responsible for over 30% of settlement delays among small firms—a clear sign that even strong cases can get bogged down by missed messages or unclear follow-ups.

To avoid these roadblocks, firms need a consistent way to track every negotiation step.

Recommendation:

Maintain a centralized record that captures:

Each offer and counteroffer

All follow-up attempts and adjuster communication

Key dates tied to demand, responses, and deadlines

Notes that give context for negotiation strategy

5. Settlement agreement

Once both parties agree to the terms of a settlement, those terms must be documented and signed in a formal agreement. This typically outlines the final compensation amount, payout timing, and any relevant provisions such as liability waivers or confidentiality. Some lien issues may be identified earlier in the case, but many are finalized during the post-settlement phase.

Despite its importance, this step is still vulnerable to errors. According to the Legal Industry Report, billing and payout errors occur in one out of five settlements, often due to oversights in the written agreement.

Recommendation:

Implement double-review procedures before finalizing any agreement to minimize the risk of post-settlement disputes. Having a second set of eyes on payment terms, release language, and client instructions helps catch mistakes that could otherwise delay or compromise the final disbursement.

6. Settlement payout

Once a settlement agreement is signed, the responsible party or insurer is required to issue payment within the agreed-upon timeframe. The law firm then distributes the funds, deducting any attorney fees, case costs, and liens before issuing the remainder to the client.

Recommendations:

Receive settlement funds electronically to speed up turnaround times.

Track all disbursements using digital reporting tools—this makes it easy to confirm payment statuses, catch discrepancies quickly, and proactively monitor settlement timelines.

7. Post-settlement

The final step in the process involves reconciling all outstanding financial details. This includes deducting attorney fees, reimbursing expenses, resolving liens, and issuing the net payout to the client. While this may seem straightforward, it’s also a stage where important details can fall through the cracks. Because settlement funds are typically held in trust before disbursement, accurate client accounting is essential.

According to the Legal Industry Report, inconsistent expense reporting contributes to 15% of revenue leakage in small firms—a sign that even modest accounting errors can add up over time and affect profitability.

Recommendation:

Conduct thorough post-settlement reviews to ensure every lien, cost, and fee is reconciled properly and that the client receives the correct payout.

Understanding the financial implications of the settlement process

The settlement process plays a central role in maintaining financial stability for personal injury firms. A consistent, well-organized approach can bring much-needed predictability to cash flow.

When attorneys track demands, negotiations, and payouts closely, they’re better equipped to forecast income, cover operational costs, and make informed financial decisions. That visibility becomes even more valuable during periods of market volatility or when disbursements are delayed.

Efficient settlement workflows also give firms the agility to adapt when conditions shift. With clear systems in place, legal teams can respond quickly to lighter caseloads, payment backlogs, or unexpected expenses without scrambling to rebalance budgets.

Rather than viewing settlements as a routine administrative task, firms should recognize them as a key driver of long-term financial health. Strengthening this part of the case lifecycle helps create a more resilient business that’s better prepared to weather uncertainty and plan for growth.

What to include on a personal injury settlement payout statement

A personal injury claim settlement statement should provide a clear breakdown of all amounts involved in the settlement, including:

Gross settlement amount: This is the total sum negotiated and agreed upon in the settlement before any deductions are made. It represents the full value of the compensation secured on behalf of the client.

Attorney fees: These are the legal fees owed to the firm, typically calculated as a percentage of the gross settlement amount under a contingency fee agreement. The percentage should be clearly stated and calculated.

Case expenses: This includes costs advanced by the firm during the course of the case—such as filing fees, expert witness fees, medical records requests, or deposition costs. These expenses are usually deducted from the settlement before the client receives their portion.

Medical liens or payments: If the client received medical treatment that was contingent on future payment, those bills or liens must be settled from the award. This section should detail which providers are being paid and in what amounts.

Net payout to the client: The final amount the client receives after all deductions. This figure should be easy to find and understand, as it directly affects the client’s expectations and satisfaction with the settlement outcome.

How personal injury law firms can leverage settlement management software

Practice management solutions designed for personal injury law firms, such as 8am CasePeer, help law firms manage settlements more effectively, reduce administrative overhead, and improve financial tracking. These tools are especially valuable for firms juggling multiple negotiations and other settlement-related tasks at once. Below is a breakdown of some of the top benefits.

1. Centralized tracking of demands and offers

Tracking every demand, offer, and counteroffer in a single system helps ensure nothing gets overlooked. With real-time visibility into case status, attorneys can quickly identify which matters require follow-up, prioritize negotiations, and set clearer expectations for clients. A centralized view also makes it easier for teams to avoid duplication and keep progress moving across multiple matters.

2. Streamlined lien resolution

Manual lien tracking is time-consuming and prone to mistakes. CasePeer simplifies this process by logging payments and resolutions in one place, so attorneys always have a clear view of what’s outstanding. That visibility reduces the risk of missed liens or overpayments and helps ensure clients receive accurate final disbursements.

3. Accurate expense tracking

Linking expenses directly to each case helps firms maintain a clear record of costs and avoid billing oversights. By automating this process, settlement management software supports more accurate fee deductions and improves insight into case-level profitability—critical information for long-term planning.

4. Detailed reporting on settlements and financials

Robust reporting tools give firm leaders the data they need to make informed decisions. With CasePeer, attorneys can generate reports on settlement activity, outstanding liens, expense recovery, and more—all of which support better forecasting and help maintain consistent cash flow.

Streamlining the personal injury settlement process with 8am CasePeer

The right tools can make a major difference in how efficiently firms manage settlements. CasePeer equips personal injury practices with built-in features that simplify every stage of the settlement process, from tracking demands to confirming disbursements.

Centralize and automate daily workflows with CasePeer. Legal teams can stay organized, reduce administrative delays, and keep financial operations on track. Essential tools include:

Centralized tracking of demands, offers, and payments to ensure clarity and prevent missteps

Automated reminders to keep payment deadlines from falling through the cracks

Team visibility tools that help attorneys and staff manage caseloads more effectively

Real-time financial reporting to support smarter spend management and steady cash flow

To discover how CasePeer can help streamline your firm’s settlement management process, schedule a demo today.

Personal injury settlement process FAQs

About the author

Justin Fisher is a Content Writer and SEO strategist for 8am, a leading professional business solution. He specializes in writing about emerging legal technology, financial wellness for law firms, and more.